Accumulation Phase

Individuals in the accumulation phase are those attempting to accumulate assets to satisfy fairly immediate needs, like down payment for a home, or longer-term goals like children’s education and retirement fund

Typically, individuals in the accumulation phase have a small net worth and heavy debts (car loans, college study loans).

Their investment horizon is long, 30 – 40 years, and can take higher risks in the hopes of making above-average returns over time through compounding.

These individuals will have a high need for Hospital & Surgical(H&S) and also Disability income insurance, as they are likely to have little savings due to their younger age & loans repayment.

Consolidation Phase

Individuals in the consolidation phase are typically past the midpoint of their careers, have paid off much or all of their outstanding debts, and are likely parents.

Earnings exceed expenses, so the excess can be channeled towards education & retirement needs.

Typical investment horizon for individuals in the consolidation phase is relatively long, 20 – 30 years, so they can take moderately risky investments, as they would not want to put their nest egg in jeopardy.

These individuals will have a high need for Hospital & Surgical(H&S) and also Whole Life or Term insurance, as they have children who are dependent on their income.

Spending Phase

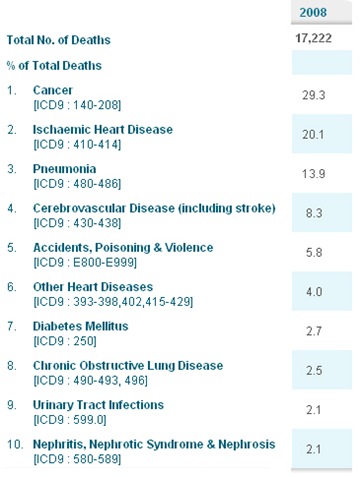

This is when individuals retire, in Singapore the official retirement age is currently 62, according to statistics the reported life spans of Singaporean Male is 77 & Female 82.

That leaves an average of 15 years for a Male & 20 years for a Female in retirement.

Individuals in this phase would be reliant on their retirement funds accumulated from previous phases.

Let’s do a VERY SIMPLE estimation of how much a typical Singaporean would have in their CPF account retiring at age 62 living in a 4-room flat:

Assuming Income from age 25 to 62 is constant = $3500/month

Amount in CPF OA+SA accounts (including interest) at age 62 = S$673,864

Less housing payment assuming half of it is paid by spouse = S$673,864 – S$216,180 = S$457,684

Using the CPF LIFE payout estimator (high payout/lower amount for beneficiaries), the individual can get:

S$2204 - S$2372 per month

If you feel that amount isn’t enough for your retirement needs, maybe you can consider starting your own retirement fund to complement CPF LIFE.

Remember, for the older You to spend an extra dollar, the younger You would have to save an extra dollar.

Insurance needs at this phase of life would be the lowest as the children are grown-up and able to take care of themselves, but it would be good to have at least a Hospital & Surgical(H&S) plan to take care of excessive medical expenses.

CPF LIFE PAYOUT ESTIMATOR can be found here:

https://www.cpf.gov.sg/cpf_trans/ssl/financial_model/lifecal/index.html